Quick Summary

- There are 4 determinants which you should look at before buying an NFT. They are liquidity, rarity, utility and ownership history. Before you get in some FOMO project, make sure you understand and apply these 4 determinants in your trading.

In recent years, the world of non-fungible tokens (NFTs) became bigger than ever before. Now it’s important more than ever to know what you are buying and what to buy. There are several factors that determine an NFTs price and you will find it out in this article, so let’s dive right in.

this might interest you: Americans Start to Give Cryptos as a Gift

NFTs Explanation

The blockchain space wouldn’t be as wild as it is today if it stayed within the traditional norms of progress. The crypto community started experimenting with the idea of token ownership and rarity and then voilà, NFTs were born. NFTs are unique tokens that only a single user can own at a given point in time. Their uniqueness and the tricky imbalance of supply and demand ensure that they are often highly priced and increase in value most of the time.

Most NFTs are built on the Ethereum blockchain, meaning that owning an NFT is equivalent to owning a significant amount of ETH, in a way. While there are a variety of other chains emerging that also allow for the building of NFTs on their networks, Ethereum is still arguably the main NFT place to be.

4 Determinants For NFT Valuation

The ability for an NFT to be literally anything is what makes it one of the most desirable and probably one of the most profitable assets to create and trade right now. Nevertheless, to further understand why and how NFTs are priced so high and what makes one NFT better than another, we will have to dive deep into the topic.

- Liquidity

Liquidity is basically just a term for how easy it is to enter or exit some trade. If you can enter and exit a trade fast, it may indicate high liquidity, and vice versa. Liquidity pools allow traders to trade their cryptocurrency assets on decentralized exchanges and various types of DeFi platforms. The independence from centralized market makers enables users to trade their desired crypto assets at their own will.

The world of NFT trading greatly values the existence of high liquidity and the existence of a systematic liquidity pool. Higher liquidity serves as proof that the NFTs are genuine, and reduces the possibility of the project being a potential rug pull.

The importance of liquidity for NFTs can be understood easily because if no one wants to purchase your owned NFT, you cannot sell it. For this reason, your NFT must have a liquidity premium backed by the ERC standards to allow you to trade them on both primary and secondary markets in exchange for the equivalent amount of ETH.

To diminish the risks, investors often prefer to invest in NFT projects with high trading volumes to ensure that the projects have high liquidity and it’s easy to sell as a result.

2. Rarity

The entire concept of NFTs stands on the principle of tokens being unique — this is what creates consistent instability in the market and why NFT prices can continue to go up, as there’s often a buyer who would like to purchase a unique piece of art at a higher price than you. This is why rarity is unarguably the basic underlying value of an NFT that defines its existence.

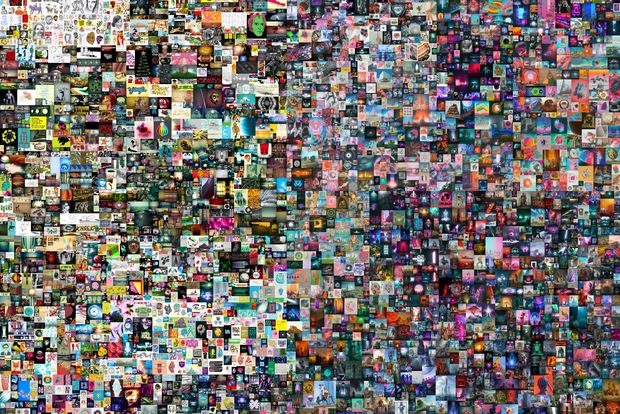

However, some NFTs are valued more than others based on different traits and the value proposition provided to the customers. Popular projects like Bored Ape Yacht Club or CryptoPunks, also known as 10K projects (10,000 piece collections), consist of 10,000 uniquely designed NFTs.

Since some pieces might have unique features that provide more value as compared to others, the creators tend to price them higher to provide their customers with an exclusive experience of purchasing a premium NFT. These rarities hold great importance in the world of crypto as the flashiness or the third eye on a profile-picture NFT might make it distinctive among a pack of thousands of similar pieces.

3. Utility

The survival of any cryptocurrency, token, or NFT project is impossible without proper utility in today’s market. Big investors tend to invest in projects that have heavy utility in their roadmaps, which allows investors to gauge the value of their assets and plan their investments.

There might be several utilities connected to owning an NFT, however, the most common are regular giveaways for NFT holders, free merchandise, entry to the community chats, or regular income in some cryptocurrency for hodling the NFT.

4. Ownership History

There is no limitation to the starting value of an NFT: it’s based on affordability and the business model of the creator. The characteristics of NFTs are basically versatile. For this reason, despite the average floor prices, some NFTs are insanely high-priced, while others are found to be extremely cheap in comparison.

However, ownership history is of paramount importance for NFT traders. Reputable artists and NFT creators tend to have high ownership history values to bookmark their product as exclusive and maintain their value in the market (e.g. artist Beeple). While this might be difficult to afford for many people, NFTs with a valuable ownership history attract a wide range of customers due to the certainty of getting their hands on an exclusive piece that has great importance in the NFT community.

Conclusion

People start to understand NFTs more with their boom in 2021 and if you want to do the right decision when buying an NFT, make sure to understand these 4 determinants: Liquidity, Rarity, Utility and Ownership History. Don’t get dragged in FOMO for no reason. Always check these determinants and you will be a few steps ahead.

more to read

Chromia – The Relational Blockchain For dApps

Sidus – The Next Generation of NFT Heroes

NFT World News Social Media: Twitter, Instagram, Telegram, Tiktok, Youtube

sources: coinmarketcap

author: Rene Remsik

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.