Aave is a decentralized protocol for lending and borrowing on the Ethereum blockchain. In the short time since it launched, it has become one of the undisputed success stories of the burgeoning DeFi scene. It is a DeFI Beast since it offers some unique features that nobody does. Aave started as ETHLend, a peer-to-peer lending platform based on Ethereum. After establishing the platform, ETHLend set up Aave as a London-based parent company. Aave is a Finnish word meaning “ghost.”

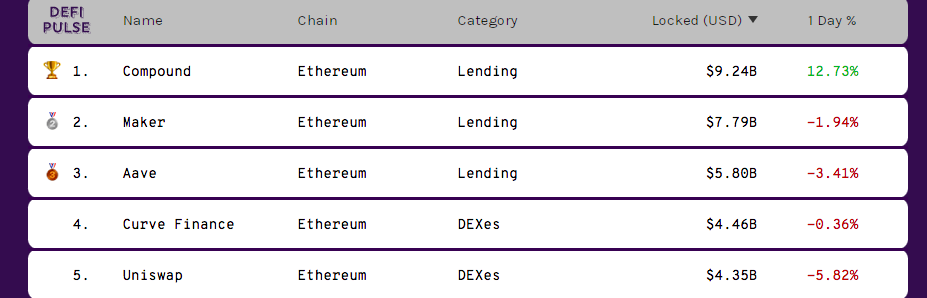

As per the Defipulse ranking Aave is the Nr. 3 protocol and currently with value locked of 5,8 Billion USD. Aave has announced that it will be implementing Polygon to offer more extensibility and also lower fees during increasing congestion on the Ethereum Network. The platform was originally launched on Ethereum L1.

Aave has quickly become one of the most important Decentralized Finance (DeFi) projects during the “DeFi Summer” of 2020. In this time DeFi took the crypto ecosystem by storm in what would become one of the biggest bull runs seen by the crypto market.

This platform is quickly establishing itself as a market leader in the lending and borrowing sector of decentralized finance (DeFi). Aave seems to be a very interesting, innovating and promising project, let’s find out if it really is in Analyse No. 15.

What is Aave and how it works?

Aave is a DeFi platform leading founder Stani Kulechov that enables users to lend and borrow cryptocurrencies in a trustless method. There are various cryptocurrencies of which to choose from. Aave offers both stable and variable interest rates to its users.

To transact on Aave, lenders must deposit funds into liquidity pools after they can borrow from these pools. Each pool sets assets aside as reserves to hedge against volatility. These reserves also help ensure that lenders can withdraw their funds when they’re ready to exit the protocol.

Aave has several different cryptocurrencies available for lending and borrowing. Some of them may be familiar to you: DAI, ETH, BAT, LINK, MANA, MKR, SNX, USDT, USDC, TUSD, USDT, sUSD, BUSD, KNC, LINK, wBTC, ZRX, and of course, LEND.

How to Use Aave?

To get started, you’ll need a Web 3.0 wallet like Metamask. Then move to https://app.aave.com/ and connect to deposit your funds. Then, you can pick an asset from there, also the amount you want to lend, and deposit your tokens to the lending pool. You can constantly monitor your accrued interest in the Aave dashboard.

You will receive aTokens when you deposit your funds. With Aave’s tokens, you will have an interest-earning asset. In that, each aToken will always equal its underlying asset. An aETH token will have the same value as ETH. aTokens will increase in number with interest earned. So, as your interest grows, your number of aTokens will grow.

How to Borrow on Aave

To borrow, the collateral must be locked up. And the amount locked up must be greater than the amount borrowed. There is a concept of overcollateralized loans. With Aave, that amount typically ranges from 50 to 75%. And borrowers must maintain the collateralization ratio. If they don’t, other users can liquidate them. And they will be incentivized to do so by buying out their undercollateralized position for a discount.

Regardless of whether a user deposits collateral for lending or borrowing, they will receive aTokens in exchange. So, 10 DAI deposited will return ten aTokens. The aTokens accrue interest from lending, and they can be redeemed on a 1:1 basis. Aave also has liquidity pools set up on Balancer and Uniswap to help with any liquidity issues so users can withdraw their funds when ready.

You hold the Defi Bank in your hands using Aave.

Aavegotchi – Fusing DeFi with Non-Fungible Tokens

One of the most recent developments to emerge from the Aave camp is Aavegotchi. Aavegotchis are ERC-721 non-fungible tokens represented by pixellated ghosts. Like Cryptokitties, their value is based on how rare they are, with the rarest Aavegotchi’s fetching the highest value.

Each Aavegotchi manages an Ethereum address that holds aTokens in escrow, meaning that users can earn interest from holding Aavegotchis. The app effectively gamifies DeFi by introducing the collectible element.

At the time of publication, Aavegotchi is still very new. In January 2021, the project confirmed it was migrating from Ethereum to the layer two Matic Network due to speed and high congestion fees on Ethereum.

It will be intriguing to see if this convergence of DeFi and NFTs achieves success, as it will potentially lay the ground for future projects to replicate and innovate further.

The Advantage Of Aave

So far, so good. If you’ve read our other articles on DeFi, many of these features that Aave offers will be familiar to you. After all, DeFi protocols share similar characteristics. Here is where Aave distinguishes itself from its coevals:

- flash Loans (uncollateralized loans),

- rate switching,

- unique collateral types.

Flash Loans

Flash loans are a huge selling point for Aave. The users don’t need any collateral to access them.

Instead of collateral, there are time requirements. How? Simple: Users must pay the loan back within the same transaction. If not, the entire transaction will fail.

Flash Loans are futuristic DeFi. They are Aave’s most significant contribution. They hold incredible potential. Since the code is open-source, other developers will be able to offer them on their platforms. And Flash Loans are native to the crypto space. They are entirely new. This means that they aren’t something that Aave borrowed from the traditional financial world and recreated in DeFi.

It seems impossible to make money with a Flash Loan given the short amount of time a trader has to work his magic. They are often used for Yield Farming, but the potential these loans possess is far from realized at this point. At present, there are three use cases for Flash Loans:

- Arbitrage

- Refinance loans

- Swap the current deposit of collateral

Interest Rate Switching

Interest rates are subject to supply and demand forces. For lending protocols like Aave, the relationship between the pool’s liquidity and the demand to borrow will determine the interest rates. When the demand for borrowing increases, it reduces available liquidity, interest rates rise, and depositors generate more income.

With Aave, however, users can switch between stable or variable interest rates, ensuring they can get the best rate for the loan. Unlike the other lending platforms, which lock users into either a fixed or variable interest rate.

The variable interest behaves as mentioned above. Algorithms determine the rate based on demand for an asset pool. With heavier demand loads, both lenders and borrowers will see an increase in interest rates.

The stable rate is different. It is determined by averaging the last 30 days of interest rates for the particular asset. Stable rates give borrowers peace of mind knowing their interest rate will not radically deviate throughout the loan’s duration.

BUT! Stable rates are not fixed interest rates. “Stable” in this case means it is a more stable type of variable interest rate. These rates are less susceptible to market volatility. Users on Aave can switch between stable and variable rates at any time.

Unique Collateral

If you’re looking for diversity when it comes to choices of collateral types, look no further. Aave has the most diverse range of DeFi collateral in the space. Except for the more popular tokens like ETH, DAI, and USDC, borrowers will soon be able to take out positions on Uniswap LP tokens and TokenSets.

The Aave Token

LEND was the Aave’s native token. When the founders launched back in 2017, they raised $600,000 worth of ETH for 1 billion LEND tokens in their ICO. Initially, the project’s name was EthLend. But a rebranding campaign settled on “Aave” in 2018, while they kept the “LEND” portion around for their native token.

The AAVE token formerly used the ticker LEND, a hangover from the previous ETHLend brand. It changed to AAVE in 2020, with token holders swapping their LEND for AAVE at a 100:1 ratio.

The AAVE token provides two core benefits to holders. AAVE holders can stake their tokens in the Aave protocol’s Safety Module. This exists to protect the Aave protocol from ever suffering a shortage of available capital to repay lenders. If the capital reserves diminish below a certain level, the Safety Module will use up to 30% of staked tokens to cover the deficit. In return for accepting this risk, AAVE holders receive a share of fees from the platform paid daily.

AAVE holders also have governance rights.

The current market capitalisation of Aave is reaching 5 Billion USD and is ranking as Nr. 26 project among all the cryptocurrencies. We have experienced huge spike from 30-40 USD levels dated November 2020 and now hitting 400 USD per token.

Conclusion

Aave has already some of the best yields in the marketplace. It offers a myriad of assets, features, and tools so that other devs can integrate some of these features into their projects.

Aave’s entry into the DeFi ecosystem has leveled up the lending and borrowing landscape, introducing more sophistication to the DeFi money markets. Beginners in DeFi lending and borrowing may be more comfortable with a platform such as Compound, which is more straightforward. However, for those with more experience in DeFi or finance in general, Aave offers more markets and features that may be attractive, such as flash loans and interest rate switching.

Overall, Aave has established itself as one of the leading DeFi projects at the cutting-edge of innovation. It is well-primed to exist long into the future. Aave’s founder Stani Kulechov believes that mainstream investors can be onboarded once the risks will be eliminated.

Source: www.academy.ivanontech.com

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.