Quick Summary

- DeFi is challenging the old ways how banks work, how financial instruments are created and how lending works. The goal of DeFi is to get rid of intermediates and make the market freer.

- Stablecoins, DEX and borrowing/lending protocols are the cornerstones of DeFi, and they offer advantages such as a more scalable ecosystem, limitless access, big room for growth, etc.

DeFi? AMM? DEX? So many new words that people get confused just hearing them, and still, they are the things that will transform technologies and finances forever. Let’s look at how DeFi changes the rules of the game.

DeFi transforms everything

Bitcoin and Ethereum are reshaping how our modern population interacts with financial instruments. A new generation of people sees cryptocurrencies as a form of payment and an investment asset at the same time.

There are many well-known centralized exchanges such as Binance, Coinbase or Huobi, where people can trade cryptocurrencies. These exchanges use different algorithms and market-making techniques that create a centralized market. DeFi (decentralized finance), on the other hand, offer whole new possibilities.

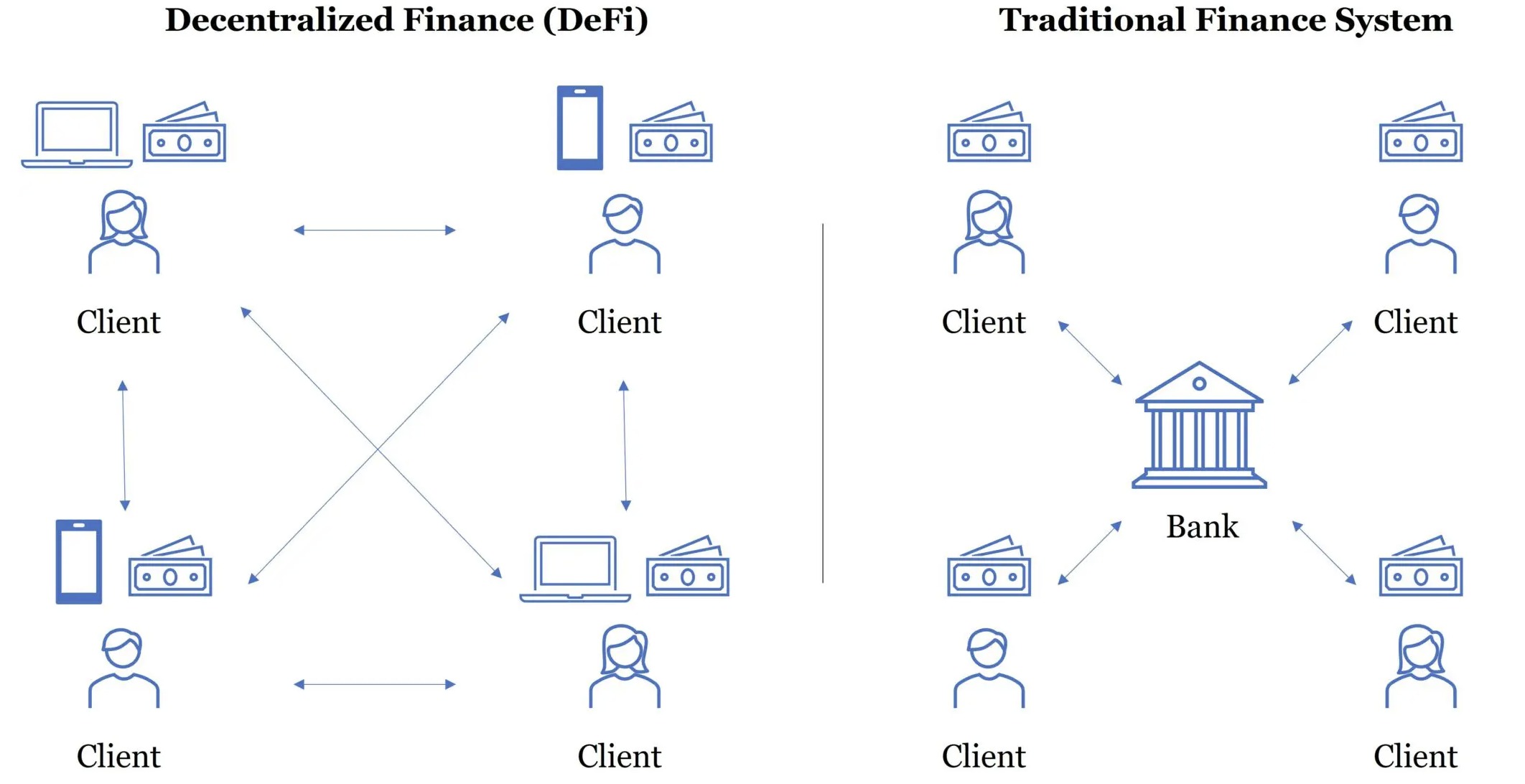

DeFi has the potential to transform how banks work and change the whole financial system from the ground up. DeFi is a concept with a vision of a financial system that functions without any intermediaries, such as banks, insurances, or clearinghouses, and is operated just by the power of smart contracts. It’s supposed to meet the standards of centralized finance but in a permissionless, transparent and global manner.

DeFi is challenging traditional finances from many angles as it accompanies blockchain, and since 2020, billions of dollars are poured into its ecosystem. This growth is mainly led by apps built on the Ethereum blockchain.

How exactly will DeFi change the entire system?

For example, DeFi protocols can provide what banks provide in a cheaper and more effective way. When banks want to provide loans, they set all the rules and criteria. If people want to borrow or lend money, they can use these applications and interest rates that are set automatically depending on supply and demand. Users also don’t have to worry about favoritism because these protocols interact with them equally at any time, any place and with any amount.

Moreover, financial instruments such as derivatives are created by central parties. DeFi allows decentral creation and trading of these kinds of derivatives on stocks, currencies, etc. Exchanges allow the trading of these assets between two or more parties. Decentralized exchanges are composed of smart contracts that provide liquidity and defined pricing mechanisms. These kinds of automated liquidity possibilities are the key to a fully independent and decentralized ecosystem.

Furthermore, stablecoins (e.g. USDT) are supposed to offer price stability thanks to their pegging to a certain asset. It started with pegging to fiat money, and now there are even stablecoins pegged to commodities or other cryptocurrencies. From a decentralized perspective, pegging to cryptocurrencies and similar assets makes sense the most.

What’s the ultimate goal of DeFi?

DeFi industry has officially acquired a serious role in the technological and financial industry. It can seriously substitute old ways and create new finance solutions.

The reason for the success of centralized exchanges is that they are the main entry point to the crypto space. Common user needs to swap fiat money to crypto in order to enter DeFi world. When people start to use DEX more, fiat money will slowly start to lose its importance and allow DeFi to grow even more and become a common term in the world.

With the development of stablecoins, DEXes, borrowing/lending protocols – the function of a payment system could become advanced in connecting savers and borrowers. This could take place through cryptocurrencies with protocols tailored for decentralized borrowing and lending (e.g. COMP is a cryptocurrency built for this purpose).

Common rules and laws do not apply in DeFi and regulators such as SEC do not like that. This is a huge advantage over traditional firms. Innovations can be developed and implemented and work freely without being regulated. However, there are manipulations and frauds done all the time without a certain central party watching over them.

DeFi has a real potential to outperform the traditional system in the following years because of these main reasons:

- fast-growing industry and scalable ecosystem

- limitless access (anybody can be a part of it)

- big room for growth ( DeFi is still just at its beginnings)

- people naturally like new ideas and innovations

Conclusion

DeFi as a term exists only for a while and already knocks on many doors. Traditional firms will have to adapt to a new system or they’ll cease to exist as a whole new market is created. DeFi will be led by a newer generation of people who are keen on blockchain, cryptocurrencies and NFTs, which will grow with DeFi.

Sentiment: positive

sources: ambcrypto, forbes, morethandigital

Rene Remsik

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.