Quick Summary:

- DeFi staking, Swapping, and Farming are the primary income sources for many investors in the new economic model of Decentralized finance.

- DeFi has brought decentralized lending and borrowing services that have more perks than traditional finance.

Decentralized finance is the new trend in the crypto space. The DeFi market is growing rapidly and new players are entering it. There are various ways to earn passive income through DeFi, like lending, trading, or staking.

Each of these methods has its own pros and cons but they all offer an opportunity for passive income with less risk than traditional investing. One of the reasons is that decentralized finance offers a lot of opportunities for passive income. The main options to earn passive income are Staking, Swapping, and Farming.

DeFi Staking

The idea of a passive income is appealing to many. It’s the idea of earning money without having to work for it. It’s the idea of being able to make money while you sleep, but that doesn’t happen with crypto staking.

Crypto staking is a form of investing in crypto assets where an individual stakes their own coins by locking them up in a wallet and receives rewards over time.

The rewards are usually distributed among all coins staked and are proportional to the amount held in the wallet. The more coins you stake, the higher your percentage share will be.

There are many benefits associated with crypto staking such as:

– Earning passive income

– Locking up your investment

– Receive periodic dividends

Binance and Bitstamp are the top CeFi staking platforms.

Biggest cryptocurrencies in the world based on total staked value on November 11, 2022 – Statista

|

Characteristic |

Staked value (in billion U.S. dollars) |

Total stake |

Reward |

|

Ethereum |

20.05 |

12.83% |

4.6% |

|

Cardano |

9.12 |

71.81% |

3.52% |

|

Solana |

6.96 |

70.97% |

5.71% |

|

BNB Chain |

6.11 |

85.61% |

4.17% |

|

USD Coin |

5.35 |

N/A |

4.99% |

|

Dai |

4.19 |

N/A |

4.95% |

|

Avalanche |

3.91 |

63.27% |

8.28% |

|

Polkadot |

3.68 |

50.44% |

14.05% |

|

Polygon |

3.57 |

37.47% |

6.39% |

|

Cosmos Hub |

2.45 |

64.51% |

19.28% |

|

Tron |

2.4 |

45.39% |

3.54% |

Crypto Swapping

Crypto Swapping is a process in which two parties exchange one cryptocurrency for another cryptocurrency without using an intermediary. This process is usually done through decentralized exchanges.

DeFi platforms are decentralized platforms that allow users to trade cryptocurrencies without the need of a centralized entity or intermediary. These platforms make use of smart contracts to facilitate the trading process, while still maintaining the trustless nature of cryptocurrencies and eliminating any risk associated with centralization.

Uniswap and PancakeSwap are renowned DeFi swapping platforms.

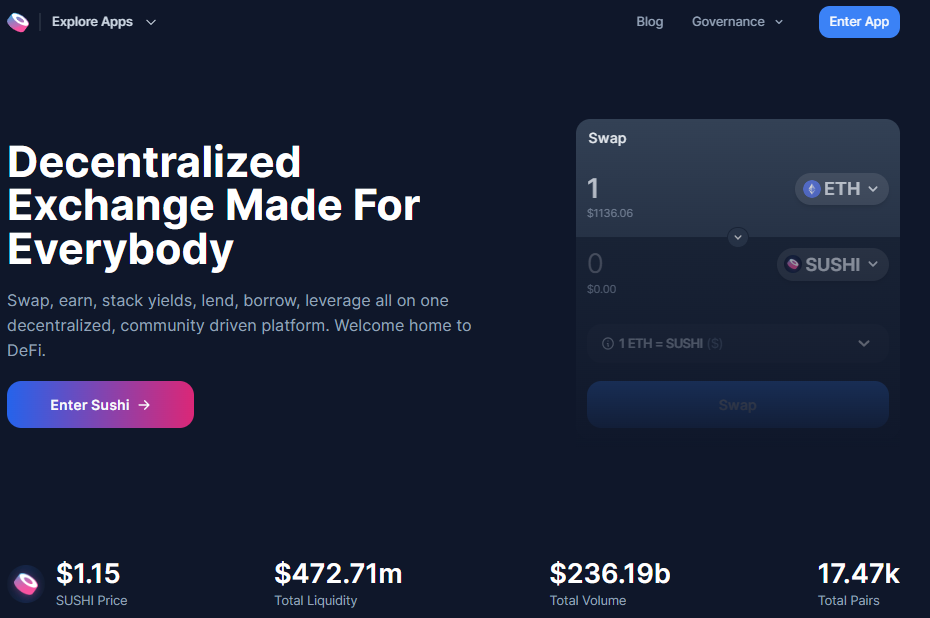

DeFi Yield Farming

DeFi Yield Farming is the process of investing in a portfolio of decentralized financial applications to generate passive income.

Investors can earn passive income by investing in a portfolio of decentralized financial applications which includes lending, trading, and insurance.

Sushiswap and Curve Finance are the main DeFi Yield farming platforms.

Conclusion

The future of decentralized finance is very promising, with many innovative projects at the forefront that offer huge APR or APY for Staking and yield farming. However, before you pour your investment into staking or Yield farming, you must be aware of the dark side of it too.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.