Quick Summary:

- Red Flags in the Ponzi Schemes and Crypto projects keep popping up, warning people not to invest in these projects.

- 5 Red Flags that are easy to spot yet so unavoidable by these malicious projects.

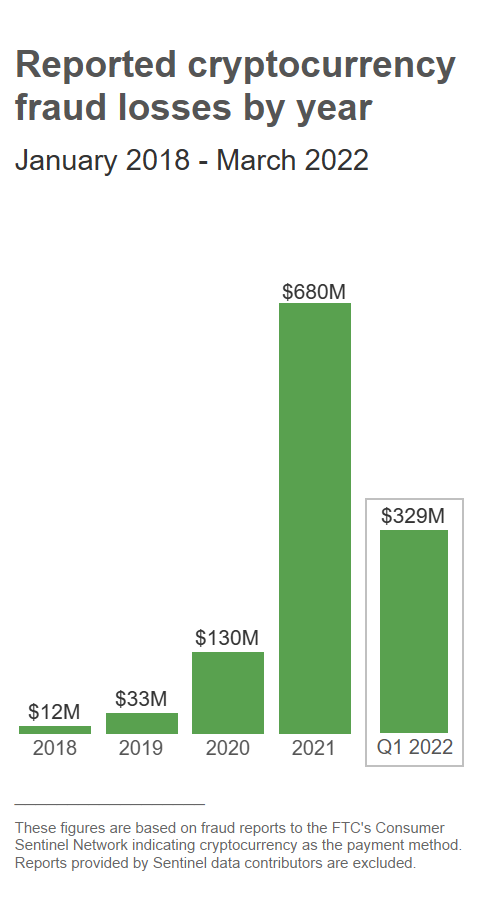

Some common red flags to watch out for when evaluating a crypto project include unrealistic promises, limited or no team information, anonymous team members, lack of technical documentation and reviews, and a lack of transparency around the project‘s finances. It‘s also important to research any project that asks you to store funds in their wallet. The number of scams in the crypto space is increasing every year.

5 Red Flags to look out for:

1. Unrealistic Promises

When evaluating a project, it‘s important to pay attention to the White Paper. Read through it thoroughly and look for any promises or guarantees that may not be feasible in the long term. Additionally, research the team behind the project and see if they have a history of backing up their claims with results. Finally, talk to people in the crypto community that are familiar with the project and get their feedback.

2. Anonymous Team:

Isn‘t it good to have an anonymous team in crypto after all Stoshi himself is unknown? Well no. The anonymity of a project’s team can be a red flag for some, as it is difficult to verify the trustworthiness of the project if the team members are unknown. That said, it is common for teams to remain anonymous in order to protect their development process and ensure that the project can develop without distraction. Ultimately, it is important to research the team and look for signs of legitimacy before investing.

3. Lack of Technical Detail and Review:

When evaluating a project, it is important to look for technical details. This can include the project’s code, documentation, and reviews from experts in the field. If the project does not provide any of these elements or offers limited information, this can be a sign that the project does not have a clear plan for development or is not built on a solid foundation. It is also important to review any available reports and feedback from users to get a better idea of the project’s technical capabilities.

4. Illiquid Project:

The best way to verify the liquidity of a crypto project is to look at its trading volume and its overall market capitalization. Trading volume indicates how much activity there is in a cryptocurrency‘s market, while market capitalization reflects the total value of a crypto project. Additionally, it is important to research the cryptocurrency exchanges that list the coin, as well as any other services that support it, such as wallets and payment processors. This will provide an indication of the coin‘s usability and its availability for trading.

5. Store Funds in Project Wallet:

Depositing crypto in an unknown wallet is a red flag because it can be difficult to recover funds if something goes wrong. Additionally, there is no way to verify the security of the wallet before depositing funds. This means that users could potentially expose their funds to malicious actors if they deposit their crypto in an unknown wallet. It is always important to research the service or wallet provider to ensure that it is trustworthy.

Conclusion:

To conclude our discussion, it is important to research any crypto project before investing. This includes looking for red flags such as unrealistic promises, limited or no team information, anonymous team members, lack of technical documentation and reviews, a lack of transparency around finances, and depositing funds in unknown wallets.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.