Quick Summary:

- FTX hack and collapse has alarmed the bell and since then thousands of Bitcoins have been taken off of the Crypto exchanges.

- Crypto influencers like CZ Binance along with Vitalik Buterin have offered a plan to prove the assets but that is the panacea of all problems.

There have been many failures on the centralized exchanges’ end but the crypto community was not talking about it until the fall of FTX. The controversy has done one better though – convincing people they can not trust the centralized exchanges with their assets. The custody of assets with these centralized exchanges is like falling into the trap of trusted 3rd parties.

How can Crypto Exchange regain trust?

- Proof of Reserves:

Proof of reserves is the audit of the crypto exchange’s holding by a third-party firm. CEO Binance and the Co-founder of Ethereum are already working jointly on a new protocol for exchanges to prove their assets. Want to learn more about Proof of Reserves and what exchanges offer this, consider reading our detailed blog here.

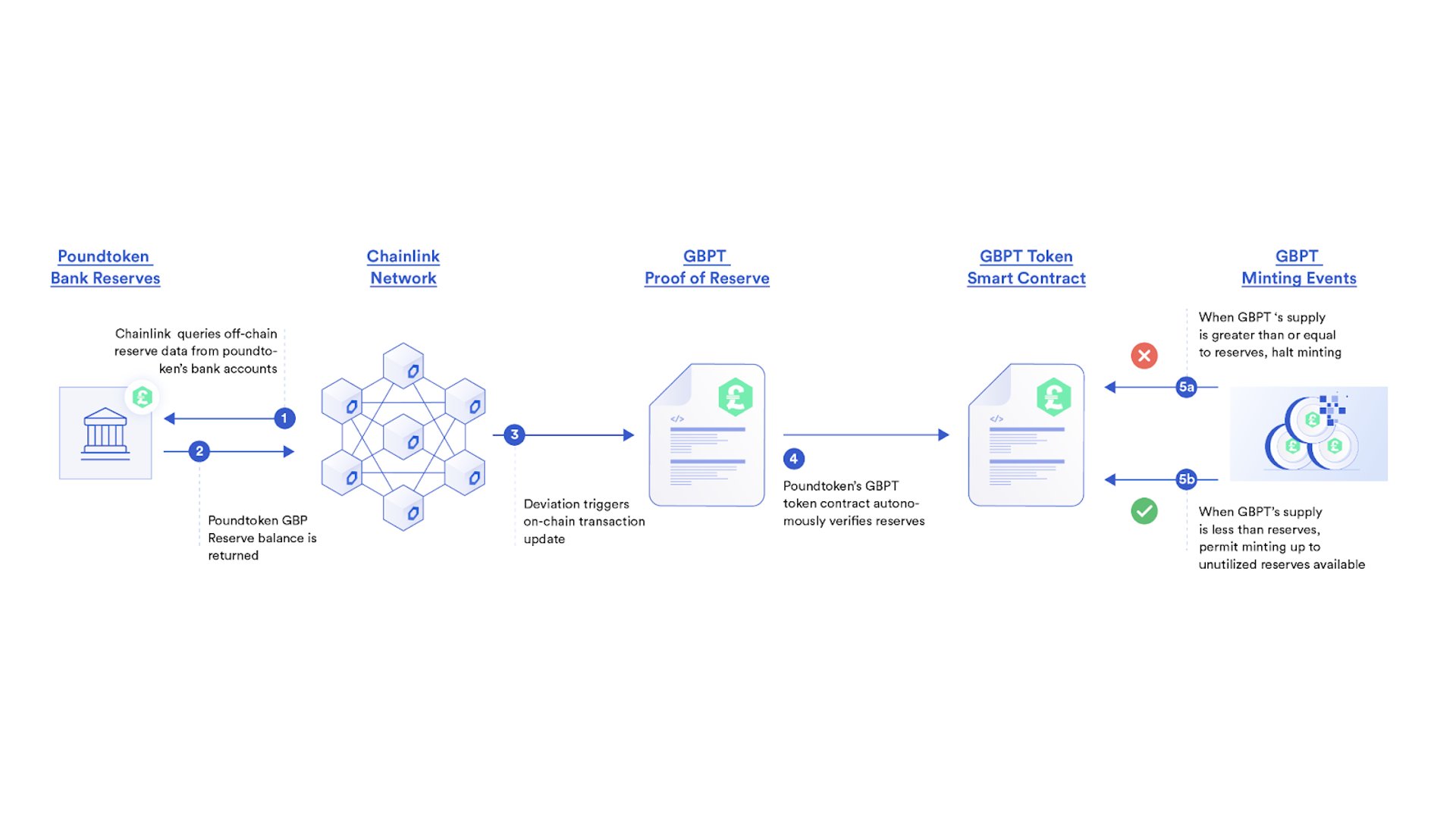

The approach to proving the exchange-held assets is different, here is how Chainlink implements Proof of Reserves.

2. Proof of Liability

If an exchange owes $20 billion to its customers then proving $2 billion through Proof of Reserves is pointless. This is possible by combining Proof of Reserves with Proof of Liability. While Proof of Reserves verifies how much an exchange holds, the Proof of Liability can show how much that exchange owes to the customers.

The future of crypto lending is transparent on chain accounting.

— Simon Ulrich (@realSimonUlrich) November 19, 2022

First we will see cashflows made transparent and eventually full financial statements.

On chain proof-of-reserves-and-liability will become table stakes for the industry with or without regulatory intervention.

3. Proof of Solvency

You might know the term solvency as the ability of a company to meet its financial obligations and the long term. However, Proof of Solvency, the term recently introduced by Vitalik holds a little different meaning. Buterin combines Proof of Reserves and Proof of liability to prove their assets on-chain for crypto exchanges.

Vitalik Explains the Proof of Solvency in the following words:

“In 2013, discussions started on how to solve the other side of the problem: proving the total size of customers’ deposits. If you prove that customers’ deposits equal X (“proof of liabilities“), and prove ownership of the private keys of X coins (“proof of assets“), then you have proof of solvency: you’ve proven the exchange has the funds to pay back all of its depositors.”

Conclusion:

Conclusively, a fair crypto exchange should have no problem proving its holdings to its customers. Nonetheless, the 3rd party exchanges are not meant to keep the funds and only Web3 wallets that offer private keys are the ultimate solution.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.