Quick Summary

- Liquidity Pools are pools filled with assets based on smart contracts that are used to help provide more liquidity for cryptocurrencies.

A liquidity pool is a smart contract where assets are locked to help traders process their trades at the desired prices. Well, that’s the definition part, let’s break it down even simpler.

related: IDO: Initial DEX Offering Explained

Liquidity Pools (LPs)

Liquidity Pools, unlike their names, are not pools filled with water; instead, they are pools filled with assets based on smart contracts. Usually, you buy something when there’s someone to sell it. However, when it comes to asking the desired price, this makes the trade even rare.

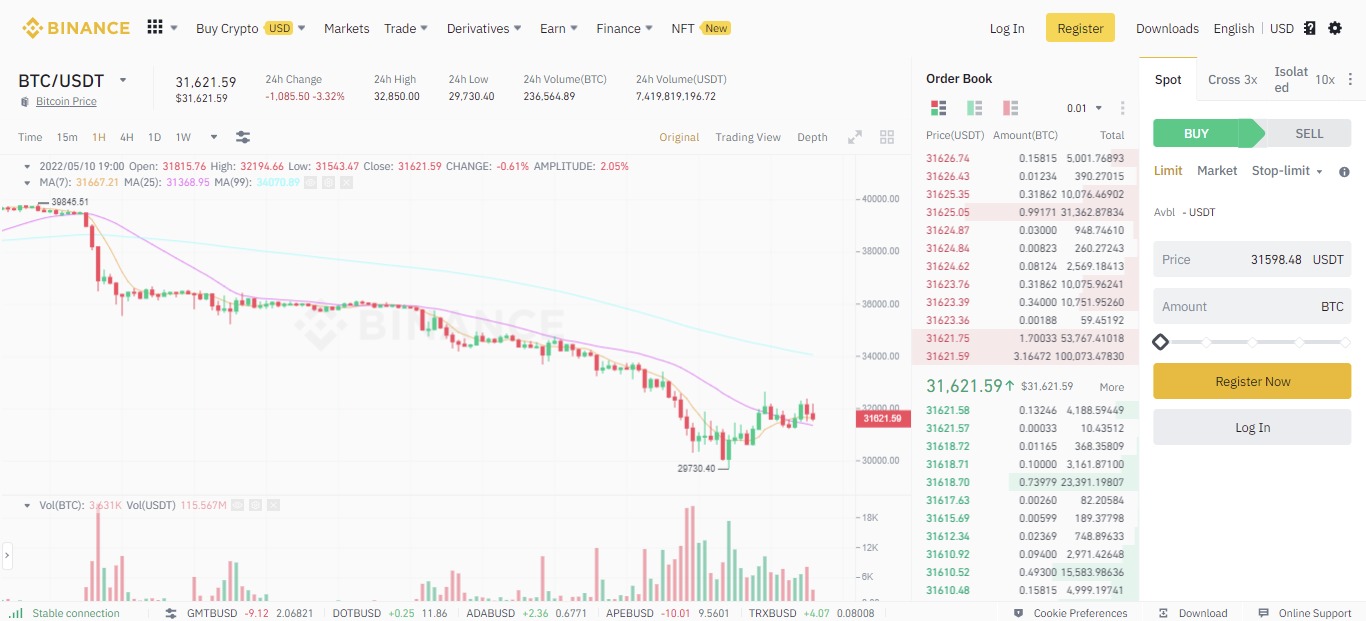

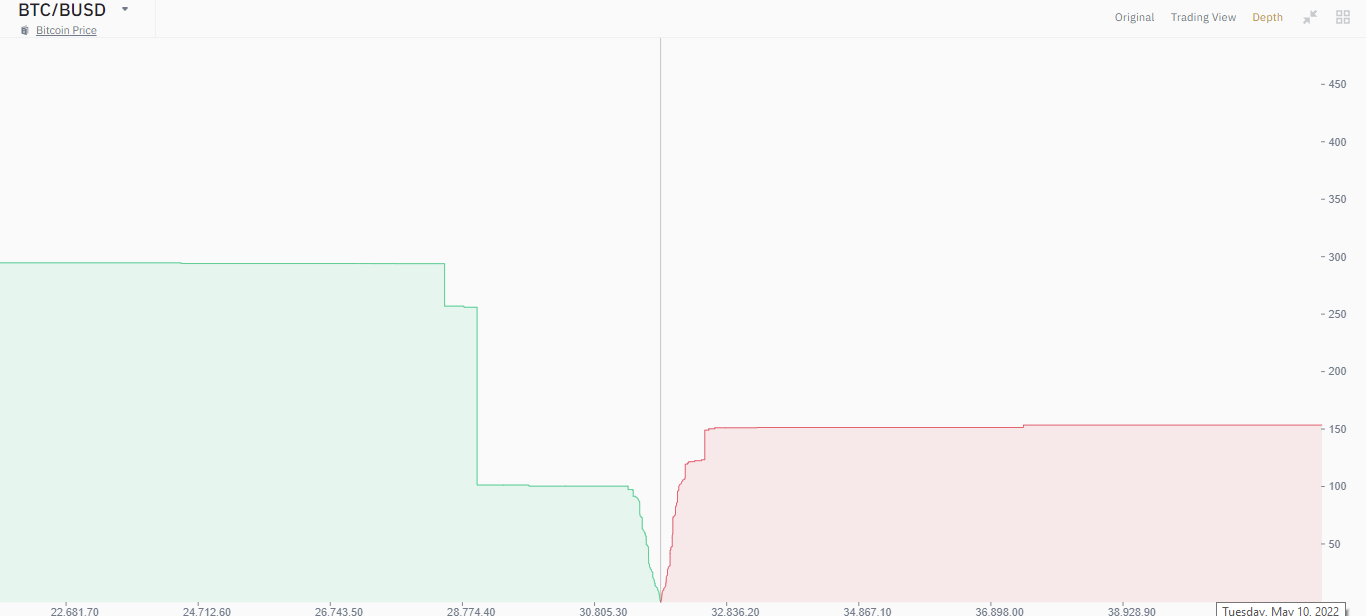

In the finance and crypto trade, the buyers and sellers book their orders in the order book. When the asked price by a seller reaches the price of the bid price of the seller, the trade executes. A buyer comes with money and records the order with a quantity of the asset required, and the seller records the order to sell at a specific price for a certain amount, as highlighted in the above image. When the trade executes, the seller gets the money, and the buyer gets the assets. The image below shows many buyers and sellers in Bitcoin trade on Binance.

Buyers Vs Sellers

Simple! But what if there are no sellers? That’s where the role of Liquidity Pools comes in. Typically, two coins are added to the pool at 50:50 on a set price with the help of smart contracts. So, for example, in a Cake-BNB Liquidity pool, Cake and BNB are added equally in the value, and you can swap your Cake coins with BNB and vice versa.

The maths is simple. The 50:50 is not quantity-based but value-based. This means that the value depends on the demand and supply mechanism. If more people are buying BNB with their Cakes, though the quantity of BNB in the liquidity pool decreases, their value will increase. If, in the start, the liquidity pool was worth $1 million ($500k BNB and $500k Cakes).

50,000 Cakes = $500k

1000 BNBs = $500k

If someone decides to buy 100 BNB with 5000 cakes, the value of cakes will drop due to selling in the liquidity pool, and the value of the remaining BNBs in the pool is as below.

55,000 Cakes = $500k

900 BNBs = $500k

The overall value in the liquidity pool remains the same, and the ratio of 50:50 in assets’ value is also intact. Although this allows buyers and market makers to buy at highly favorable prices, the technique is also used by the scammers to pull the rug on investors; you can read here in detail how scammers use yanking Liquidity Pools to scam the investors.

more to read

The Meta Key: Enter The Metaverse

Tripsters: Playful NFTs That Made a Lot of Noise

Follow NWN: Twitter, Instagram, Telegram, Tiktok, Youtube, Twitch

sources: binance

author: mnmansha

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.